debt doesn't matter.

(yet)

This article is a response to a comment by sebjenseb.

There are many dramatic, unprecedented trends going on that no one seems to care about. Americans are getting fatter. Birth rates are plummeting in almost every single country in the world. In developed countries, the elderly and retired population is on its way to outnumbering the working-age population for the first time in history.

Military recruitment in NATO countries is down, due to both aging and obesity, but also a lack of patriotism. LGBTQ identification is increasing exponentially.1 Americans are leaving churches at the highest rate ever. Whites are becoming a minority, which Republicans claim is ok as long as it is done LEGALLY. The debt is increasing to astronomical levels.

In this article, I will argue that the average person is fairly rational in not caring about these dramatic trends because none of these things are very bad. I am not a nihilist. I believe things matter, like the military, and the economy, and politics. But low birth rates, obesity, atheism, and LGBTQ identification are a form of McGenics. Declining ethnocentrism is a necessary part of globalization. That’s not to say that these trends don’t have negative consequences, but that the good outweighs the bad.

The most dangerous trend on the list so far is the aging of the population, which creates an unsustainable economic burden. The solution to that problem is either to cure aging or to end the socialism of the old.

I am sure that medical science can extend biological life, but I am not sure that it can extend productive work years without incurring massive costs. Maybe there is a medical procedure that could increase your lifespan by 10 years, but the cost would be so enormous that the net contribution to the economy would still be negative. I don’t know enough about biological science to determine this.

Regarding the socialism of the old, read Hanania.

What about debt? Is that a real problem, or a fake one?

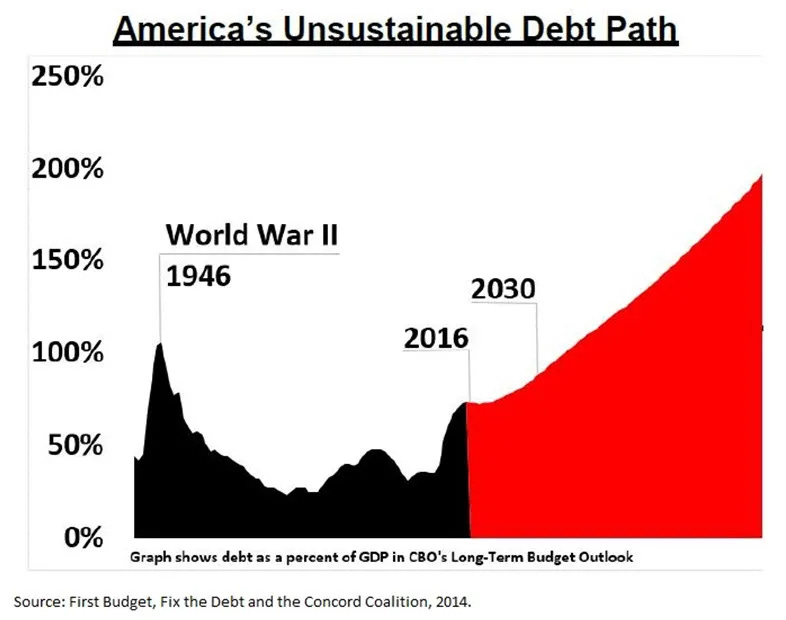

debt numbers look pretty bad:

The average salary in America is $65,470. If we assume Americans begin full-time high-skilled employment at 25, and retire at 65, this means the average American earns $2,618,800 over their lifetime. Roughly 29.9% of this goes to taxes, or around $783,021 (enough to buy two extra houses or ten extra cars!). Based on the projections of the Heritage Foundation, a child born in 2024 will have a public debt burden of $209,707 by 2054. Even if all increases in spending were halted (unlikely), this would still require each American, on average, to be taxed 37.9% of their income in order to eliminate the debt over 40 years.

A tax rate of 37.9% is not the highest in the world. This would still be far behind the German tax rate of 47.9%. The fact that German taxes are so high reflects well on the German population. Taxes disincentivize private investment, entrepreneurship, and employment. Taxes lower productive risk taking, like starting new businesses, research and development, and economic mobility. Taxes reduce savings, and reduced savings prevents growth. The fact that Germany is not a third world country is a testament to the high quality of the German worker.

If Americans raised taxes by 8% to eliminate the debt, this would represent an average loss of $5,238 per American per year for 40 years. It should be noted that 40.1% of Americans pay no income tax at all, so this burden would hit middle class Americans the hardest. Poor Americans would still be hurt, because a decline in economic growth means less expansion for businesses, less inventions, and less job opportunities. But poor Americans don’t see any direct connection between taxing the middle class and their own fortunes.

Rich Americans can easily afford a higher tax burden without reducing their own personal comfort, but again, taxes on rich Americans will reduce private investment in business, which also hurts the middle class. Everyone in the economy would be hurt by higher taxes, but that pain would be most obvious for the middle class.

Generally, when socialists propose increasing taxes, they argue that government programs can create economic growth by giving poor people healthcare, education, and housing. When poor people have access to basic services, their ability to invest in themselves and their skills increases. This is the rebuttal to the argument that vagrants should “just get a job.” It is hard to get a job when you don’t have access to safety from crime, cold, rain, sickness; it is hard to get a job without transportation, a warm shower, or clean clothing. Socialism presents itself as an investment in workers, and expects that once these workers are uplifted, they will pay back society with increased productivity.

On a more cultural level, it could also be argued that a basic level of economic development is required for patriotism to flourish. If a population is starving, sick, cold, illiterate, miserable, and must prostitute itself to survive, it is unlikely to develop any loyalty to the concept of the state or the national community. Some level of socialism may be necessary not just to safeguard against popular revolutions, but also to generate the patriotism necessary to fuel volunteer armies, as opposed to mercenaries.

However, a debt-tax wouldn’t do any of that. It would hurt Americans in the short term for the sake of ameliorating an abstract and far-away problem. In a democratic system, there are two pressures on the state: corporate lobbying and popular sentiment. There is no specific corporate interest in reducing the federal debt, but the opposite: corporations prefer short-term profits over the long-term viability of the state. Similarly, voters are more responsive to the economy in the short-term than long-term projections.

Under Donald Trump, the economy was generally good. Trump increased the national debt. In the long term, Donald Trump’s actions were probably harmful to our children and grandchildren. However, voters and corporations alike are unable to respond to these long-term incentives, and as a result, there is no democratic mechanism to reduce the federal debt. If the federal debt is a problem, it requires something like a “deep state” to address it.

Without a “deep state” intervention, is there any other way to reduce federal debt? What if instead of raising taxes, Americans became so fantastically rich that government income increased without increasing the tax burden? How much wealth would need to be generated?

The additional income needed is $5,238 per person over 40 years. Assuming the tax rate remains at 29.9%, this means that the average American salary would need to increase by $17,518 to $82,988. This would represent a growth in wages of 26.76%.

Since 2022, wages have risen by an average of 1.43% per year. Some of this is a “bounceback” effect from the 2022 “recession.”

Since 1979, real wages have only grown 4% for the bottom 10% of workers. For lower-middle wage workers and high-wage workers, growth has been 44-48%. For middle-wage and upper-middle wage workers, growth has only been 20-28%. Since only middle-to-high wage workers are net contributors to the tax base, the increase in wages for lower-wage workers only matters to the extent that they break out of their bracket and join the tax-paying class.

Based on current trends, it does look as if increases in wages over the next 40 years will increase wages by a minimum of 20%, which will significantly help pay off the existing federal debt. This is assuming that America does not crash and burn due to nuclear war, Civil War, or mass immigration.

However, one could argue that such terrible problems would overshadow the federal debt, and at that point, the debt would be the least of our worries. In other words, whether or not the debt comes into play, or matters at all, is only downstream of much larger and more impactful structural issues, like the economic competency of the population and the security of the state.

Still, even if America increases the wages of net taxpayers by the needed 26.76% over the next 40 years, that would only pay off the debt if spending was halted today. That is not likely, for the same reason that an increase in taxation is not likely. Neither voters nor corporate lobbyists have an interest in decreasing spending. Corporate lobbyists want to reduce regulation, or increase subsidies, but they do not care about the long-term health of the state. Voters want free stuff. The military wants more stuff. Voters and corporations alike agree: “it’s my money, and I need it now!”

Rising wages mean that the federal debt will probably not increase as much as it otherwise would. But it probably won’t crush the debt or eliminate it in the next 40 years. Debt is here to stay. But won’t creditors eventually seek a repayment on the debt?

Will the debt be called?

This is where the story becomes abstract and maybe even nonsensical. The United States is constantly repaying and restructuring debt, but it is also constantly borrowing. In fact, America regularly borrows money in order to make payments on existing debt. Welcome to Modern Monetary Theory.

If an individual, like Bernie Madoff, engaged in such a scheme, it would be called a pyramid scheme. Is the United States defrauding investors by borrowing money to pay loans on borrowed money? Why do China and Japan keep buying our debt? If it’s a scam, are they stupid?

While the governments of China and Japan (along with India, Brazil, Switzerland, and many others) are not always correct in their decisions, it seems unlikely that so many countries would simultaneously buy into a colossal and obvious scam.

Why do Americans pay taxes? Americans pay taxes because they fear prosecution by the state, and believe it is easier to follow the law than to break it. If the government taxed people 99%, or it stopped enforcing the law, less people would pay their taxes. When countries buy American debt, this could be compared to a country paying tribute to America, or paying taxes to America. They are buying American debt because they believe it is easier to hold dollars than to “go on their own.”

The problem of investment is risk. If you buy a stock, bond, real estate, gold, a company, certification, education, training, advice, or any other investment, there is a risk that the time and money invested will be greater than the resulting revenue. Even physical objects can break, degrade, or be stolen.

During WWII, Alan Turing thought Britain would be invaded and the British pound would lose its value. He buried silver bars in the ground as an investment. Later, when he went to dig them up, he forgot where they were buried. No investment is perfect.

The question is not whether American debt is a perfect investment, but whether it is a better investment than other investments. Generally speaking, all governments engage in investment, and some level of diversity helps reduce risk. American debt is just one form of investment in a basket of different investments.

If a country had a currency which was superior to America’s, there would be no reason to buy American debt. However, the American currency is generally held to be the most stable and therefore the most valuable currency in the world. Why is this?

the reserve currency:

The dollar is the global reserve currency for three reasons:

Political stability;

Economic growth;

Military dominance.

Political stability:

America is remarkably stable when compared to countries in South America, Asia, and Europe. There hasn't been a major war on American soil since 1865, and even that was a crushing victory for the federal government. In comparison, WWII and the Chinese Civil War were both absolutely devastating and reduced those countries (before their recovery) to abject poverty and starvation.

Even at the height of the American Civil War, America’s economy continued to grow, and starvation was not a significant problem in the North. During the American Civil War, 2.5% of the population died, mostly in the South. This is marginal compared to the 10-20% of Europeans who died in central and eastern Europe during WWII, or in China during the Civil War.

The American Revolutionary was even less destructive, since it pitted a small continental army against a small British expeditionary force, with 97% of the population being uninvolved and uninspired to join in the violence.

To find a war on par with WWII or the Chinese Civil War, you have to go all the way back to 1676, to King Philip’s War. Even Switzerland had the Sonderbund War of 1847. In historical terms, this is an absurdly long time.

South America has been subject to internal disputes over communism and cartels; Europe has Ukraine; China and India have had revolutionary changes in government.

Economic growth:

Since austerity and taxation are difficult to promote outside of socialist policies (and debt payments do not have the same appeal as free stuff), economic growth is the best way to fight inflation. If you print one trillion dollars, but GDP also increases by one trillion dollars, there is less inflationary pressure on the currency. The Federal Reserve’s goal of 2% inflation per year falls in line with the target growth rate of 2% per year.

From 1961 to 2023, American GDP growth per year has been, on average, 2.998%, for a total growth of 188.88% over this period. If the Fed reaches its goal, hyperinflation is unlikely, even as debt balloons.

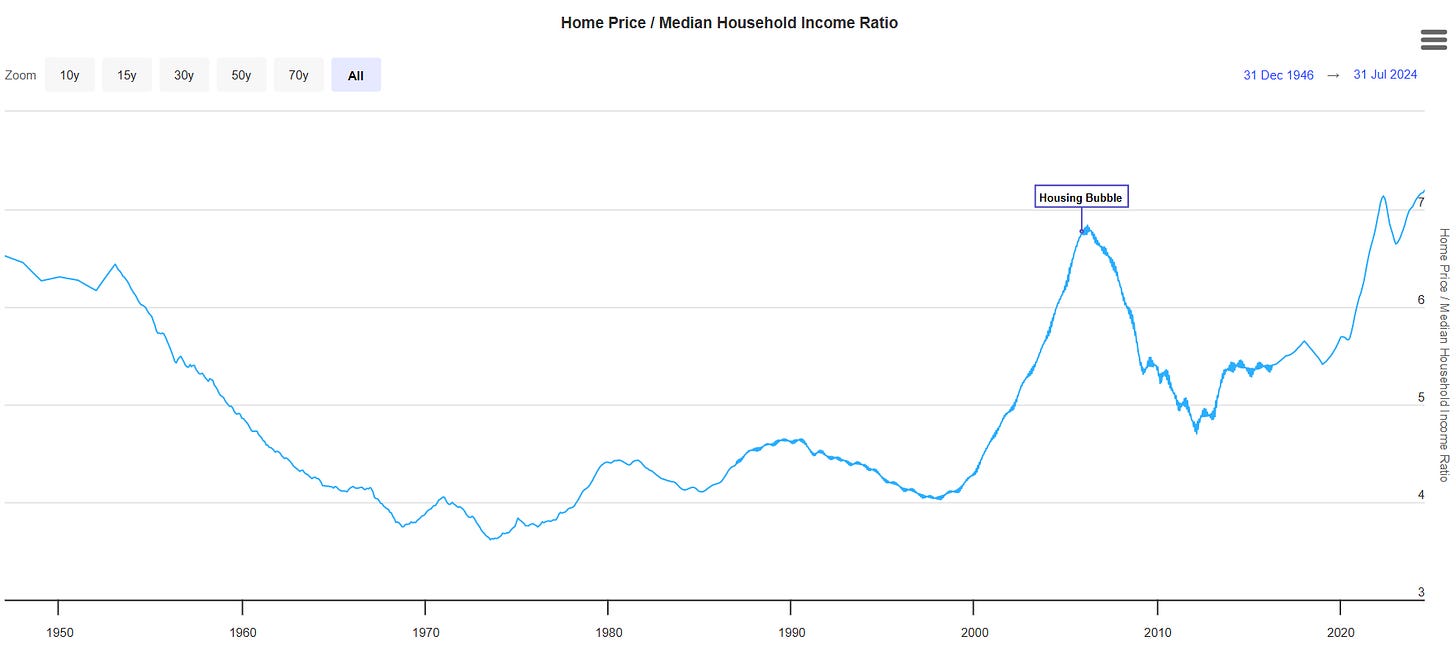

This does actually reflect personal finances. The average homeowner has loans which far exceed their yearly income. Historically, home prices range from 4-7x yearly income. If America was a homeowner, then we could be $203 trillion in debt, and still be within the normal range for homeowners. Having a large debt isn’t a problem with a steady income. But no one is predicting that America’s debt is going to exceed 4x GDP within this century.

This metaphor between America and homeownership requires a stable international financial environment. Home mortgages only work because banks trust borrowers to pay back their loans, due to their credit score. If America’s credit score declines, or international trust in financial institutions decreases, this would be bad for America’s mortgage.

The military:

The American military is willing and able to put pressure on “breakaway civilizations” who attempt to move away or disrupt American global hegemony, like Cuba, Venezuela, Iraq, Libya, Iran, North Korea, and Russia. China is a big exception to this military pressure, but China's economy is also deeply dependent on America.

America accounts for 16% of China’s exports, and the EU accounts for 21% of China’s exports. 20% of China’s economy comes from exports. Chinese exports are facilitated and permitted by America allied naval superiority in Taiwan, Japan, South Korea, and the Philippines.

It is impossible for China to ship anything by sea without the permission of the United States and its allies. Indonesia is the only power that is potentially neutral in the Pacific, but the Malacca Strait is controlled by Singapore, not by Indonesia. If Indonesia were to become a proxy of China, a joint Filipino-Australia invasion of key choke points and minor islands would be enough to entrap China. The Pacific Ocean is an American lake, and China is just living in it.

None of this would be possible without America’s overwhelming naval dominance. Regarding shipping lanes, the primary means of attacking Chinese trade would come via submarine warfare. America has 72 nuclear submarines, and China only has 12. China is trying to build more, but they are sinking. So much for the genius of Chinese engineering. If China is able to outbuild America’s navy, this will present a major threat to the American dollar-debt system.

soft PEGGING (not that kind of pegging)

Without economic, political, or military instability, it’s hard to imagine a global move away from the dollar. As long as 180 countries continue to trade in dollars, especially China, Europe, South America, and the Middle East, the American dollar-debt system will continue to off-load inflationary pressure onto the entire world.

If America was autarkic and didn't trade at all, then printing trillions of dollars would result in hyper-inflation. However, with the USD as the reserve currency, this inflationary pressure is distributed over a global economy. The dollar is effectively “soft pegged” to the Euro and to the majority of the world's oil trade (with the exception of Russia).

Even Venezuelans, arch-enemies of America, are forced to use dollars.

Russian GDP is 2% of global GDP. The loss of Russia isn't that significant, but even if it was, Russia's trade in Yuan can be thought of as a proxy for the USD, because it is also pegged to the dollar. Similarly, Iran’s move away from the dollar and toward the Yuan is somewhat superficial, considering the relationship between the Yuan and the dollar.

Conclusion:

The debt will become a problem if:

The American economy stops growing;

The American military stops growing;

Global trade declines significantly.

Will the American economy stop growing? Nothing good lasts forever. One vision of the future is that mass immigration and increasing government regulation will strangle the American economy. However, California has the most immigration and most regulation and its GDP is still increasing. The American immigration system is uniquely competitive when compared to Canada or Britain. Illegal immigration acts as a (slave) system for suppressing wages, and Canada/Britain don't allow for under-the-table cheap labor the way California does.

Will the American military stop growing? Under Trump, this does not seem likely; it also does not seem likely under the watch of Hillary Clinton and Liz Cheney. Since the end of the Cold War, American military spending has mostly held steady around 4%.

Will global trade decrease? If global trade decreases, America will become more autarkic, which will reduce the off-loading of inflationary pressure. A decrease in global trade could occur as a result of another pandemic, but that is a short-term effect. More long-term effects would be dictated by political or military conflicts, focused on Taiwan or Ukraine. The growth of international is largely determined by political and military stability.

Trump’s tariffs will likely decrease global trade, and as a result, will almost certainly increase inflation. The logic of tariffs may be that too much outsourcing has reduced America’s real military capacity. Yes, America has the best military on paper, but most of its fighting force is experimental and not battle tested against a trillion dollar GDP. The same could be said of any other country. Tariffs could be justified on the grounds that manufacturing capacity is the bedrock of military capacity, and without sufficient military capacity, America can not maintain the dollar-debt system.

This is a tricky balancing act. Free trade allows China to grow, which threatens American hegemony. But tariffs reduces trade, and as a result, reduces purchases of American debt. The third aspect to consider is American political stability. Will tariffs benefit the American working class, reducing tension and polarization? Or is political tension a result of religious shifts which cannot be resolved with economic band-aids?

Since Kamala Harris conceded the 2024 election, the rhetoric about Civil War has deflated. At the risk of sullying my argument with a personal attack, I find Tim Pool’s insistence that political violence is inevitable to be feminine, hysterical, and populist. It is possible that America experiences an AI recession in the next four years, but this will be temporary and off-set by the eventual gains from AI. The most likely threat to the dollar-debt system is not from domestic politics or economics, but international military threats.

Conservatives only care about 17 year olds. They have no plan to address LGBTQ identification among 18 year olds. Furthermore, they don’t care about gay kids, but only care about hormones and surgeries for kids, which represents less than 1% of LGBTQ activity among children. The vast majority of anxiety, depression, drug use, childlessness correlated with LGBTQ has nothing to do with transgenderism, but garden-variety homosexuality and bisexuality. The fact that these issues are getting worse over time indicates that they are not caused by “heteronormative bullying,” but some deeper underlying cause.

My point here isn't to demonize gay people, but to demonstrate that the average person really doesn’t care at all about any of the ways in which our society is massively transforming.

If lgbt is eugenics, why are gay people being encouraged to reproduce via media rep, sperm banks & surrogacy?

Well there is this whole Jack Ryan movie, where the plot consists of an attempt by a Russian oligarch to buy up huge swaths of US debt, stage a fake terrorist attack and them dump it all on the market to cause a financial meltdown in the US. Not sure how feasable that is in real life though.