Should you buy the SPY?

[Not financial advice; I’ve only ever lost money in stocks; this is for entertainment purposes only; do the opposite of whatever I say. End disclaimer.]

I would prefer that Trump didn’t put tariffs on allies. I prefer the highest growth rate possible. But he did, and here we are. Will the market continue to go down, or will it quickly recover, as it did in April 2020?

some political considerations:

Tariffs are bad. Since 26.6% of the American economy is imports/exports, a 10% tariff across the board could suppress growth by 2.6% per year. The average tariff rate is now 22.5%, the highest since 1909. Even if Trump reduces some tariffs, reciprocal tariffs from China might still keep the net tariff increase1 at the current level, which could suppress economic growth by 6% overall.

There has only been one president in the last 100 years to deliver negative economic growth over the course of his term: Herbert Hoover. The second worst performer was Truman at 1.4%, and Bush Sr. at 1.8%.

The minimum growth rate needed for a party to maintain control of the White House is 3.6%2 — this is what Reagan accomplished, to hand off the presidency to Bush Sr. Below 3.6% growth, the White House always changes hands after the incumbent is term limited.

Assume that Trump achieves extraordinary economic growth, on the level of FDR — 10.1%. But this growth is suppressed 6% by tariffs, leading to a net growth rate of 4.1%. That’s enough for Vance to get in the White House. But if Trump only achieves less than 9.6% economic growth before the adjustment for tariffs, Vance will lose in 2028.

It’s possible to grow the economy by 5.2% and still lose the election: LBJ accomplished this in 1968, largely due to America having some of the worst riots of all time, combined with the failure of the Vietnam War. So even if Trump achieves a pre-tariff growth rate of 11.2%, it still doesn’t guarantee Vance a victory in 2028.

The AI Boost

Goldman Sachs estimates that AI will boost GDP by 1.4% per year for the next 10 years.3 This is the highest figure I could find, with other estimates saying this is 10x too high.

I am an AI bull. China’s AI has exceeded expectations, and AI gains in China can easily be stolen and transferred to America. It’s very difficult to prevent the productivity gains in AI in one country from spreading to another country.

Sebjenseb estimates a minimum per capita gain of 0.5% per year, but since the population is growing by 0.5% per year, the net GDP growth would be 1%. If we take his higher estimate of $300k per year, this comes out to a GDP growth of 3.79% per year. This means an AI boost of 1.49% per year, which is slightly higher than the Goldman Sachs estimate, but not by much.

The effect of AI may be underestimated in the short term, and overestimated in the long term. For example, if there is a nuclear war in 2040, AI would be very good at conducting this nuclear war, but the net effect would be a massive economic contraction. Increases in efficiency do not necessarily translate into economic stability, as inventions like the chariot or mounted archers show us. Early agriculture had negative health benefits, which could be taken as a decrease in effective GDP per capita.

AI could end up increasing catastrophic risks by allowing non-state actors greater relative offensive capacity in the realm of cyberwarfare. The invention of AI would be like the invention of the machine gun or the tank — a weapon which shreds defensive capacities. When defensive capacities overwhelm offensive capacities (armored knights), this increases social stability. When offensive capacities overwhelm defensive capacities (machine guns and tanks), this decreases social stability. Think of the Indo-Europeans, Sea People, Huns, Vandals, or Mongols: relatively small populations overwhelming larger centralized states. AI as a weapon of war could spell civilizational collapse, or at least global economic contraction.

the SPY isn’t the economy!

So far, we’ve been talking about raw/real economic growth, adjusted for inflation. But the SPY isn’t a measure of economic growth — it’s (ideally) a measure of economic growth plus inflation.

If the SPY increases by 7%, and inflation goes up 7%, the net real return is 0%. But it’s still better to invest in the SPY than to let your money sit in cash, or a 5% treasury bond.

Unlike other forms of taxation, tariffs are fairly inflationary. If Trump announced a 10% increase in the income tax, for example, the price of goods probably wouldn’t increase. It would hurt the economy, and cause a recession, and negatively impact growth in the stock market. But because tariffs are inflationary, even if real economic growth slows down, inflationary pressure will keep the stock market riding high, which means that the SPY will still be a good place to park your money.

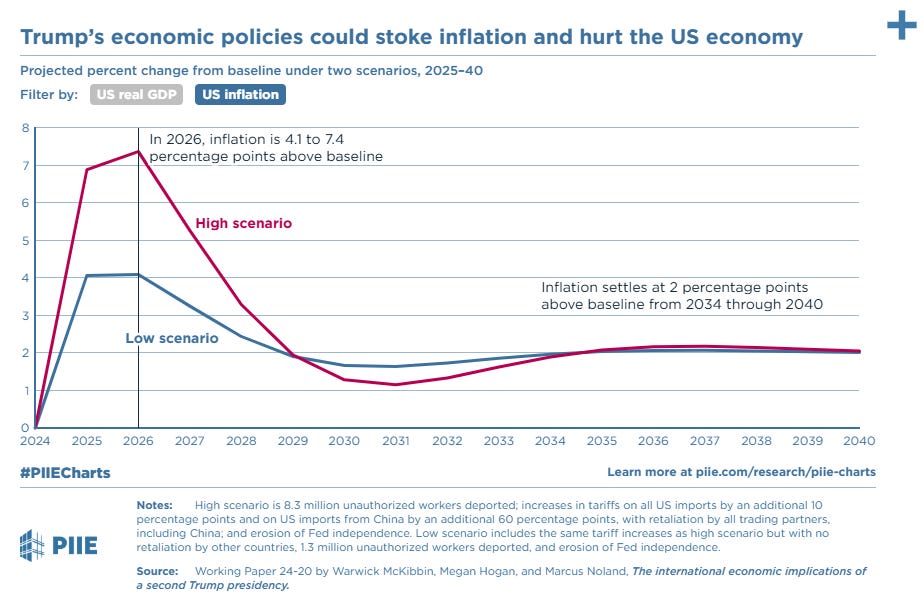

The Trump administration has declared that it expects a 2.5% inflationary effect for every 10% increase in tariffs. This is an underestimate, but let’s go with it.

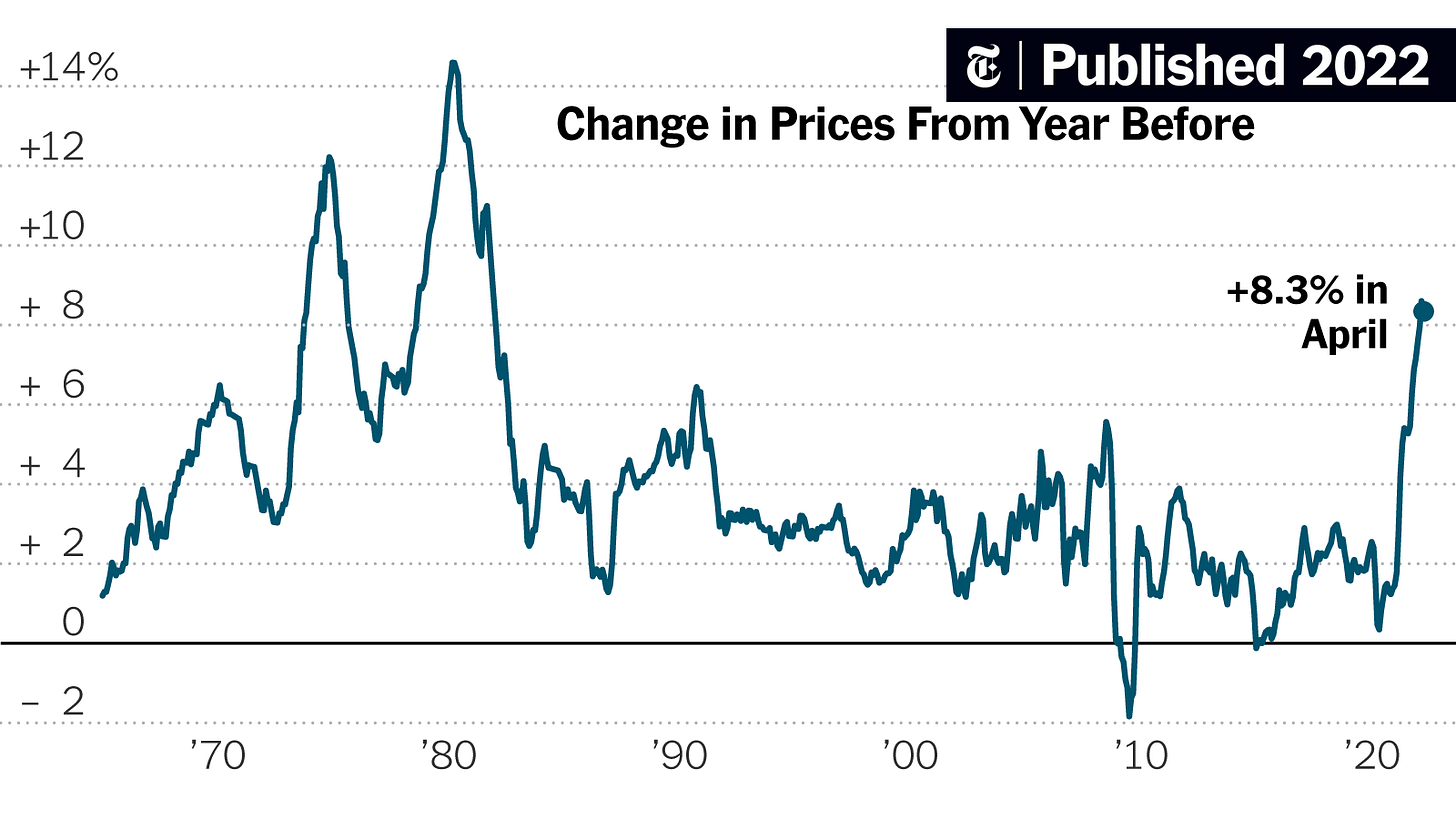

Inflation is currently around 2.8%. Assuming new tariffs are an increase of 20%, this give us a total inflation rate of 7.8%, which is higher than what Americans saw between 2020 and 2023.

In the worst case scenario, imagine that Trump’s pre-tariff / pre-AI growth would have been 2.3%. AI boosts this to 3.8%, but then tariffs drag it down to -2.2%. This would be exactly as bad as the COVID correction.

But if inflation is 7.8%, then the net annual growth of the SPY (inflation minus contraction) should (ideally) sit around 5.6%, which is still higher than Treasury Bond rates for most of the last 25 years.

There are some really apocalyptic inflation predictions out there, going up to 10.2%.

Even if real GDP declined by 9.7%, which would be Great Depression levels, it would still be smarter to put your money in the SPY than to put it in Treasury Bonds or keep it in cash. The only way to beat inflation, other than the SPY, is if Treasury Bonds exceed inflation. They didn’t do that under Biden. Trump doesn’t directly control Treasury yields, and neither does the Fed, but both the President and the Fed can try to influence yield rates. The last we heard from Trump, he was trying to keep yields low — possibly because he knows if yields get too high, people will flee from the stock market, and he wants to keep the market as hot as possible.

This contradicts the conspiracy theory that Trump is intentionally trying to crash the stock market.

the long-term picture:

If Canada and Mexico are any indication, then Trump will likely re-negotiate and slash half of his tariffs over the next 2 years. The tariff rate under Trump will be higher than it was under Biden, but it will be lower than 23%.

The panic selling driving the market down is fueled by the hysterical speculation that a reduction of growth due to tariffs under Trump will lead to a net economic contraction, but this isn’t necessarily true. No president has seen a net economic contraction during their term since Hoover, so Trump would have to be uniquely bad for this to occur.

When you combine this fact with inflation, the SPY will be higher in 2026 than it is currently, so you should buy it.

Let’s say Trump raised tariffs by 1%, instead of 10%. That would certainly slow growth. But would it eliminate growth, and cause a contraction? Probably not.

It’s difficult to know what tariff rate would be necessary to cause a long-term contraction. When I say long-term contraction, think of the 2000 Dot-Com Bubble, or the 2008 Recession, where markets didn’t recover for several years.

I don’t think that’s in the cards, for a few reasons.

Trump has demonstrated his willingness to negotiate on tariffs.

Democrats are exaggerating the panic for political purposes. (This is a good political strategy, but not something to base your stock portfolio on)

Tariffs can be bad for growth without completely ceasing growth, if they are counter-balanced with AI.

The most likely scenario is that the average tariff rate is reduced over the coming months and years, which will make the market happy. Every time Trump slashes or re-negotiates a tariff, it will boost the stock market.

Consumer sentiment is low, but it’s not impacting hiring data. Compare this to 2020, where a lot of people actually lost their jobs, or 2022, where inflation was - drastic.

Specific economic predictions:

GROCERIES: In 2022, American farmers raised prices because international markets generated greater demand in the absence of Russian/Ukrainian wheat. This time, food prices are unlikely to rise with inflation because American farmers under tariffs have reduced access to international markets, reducing demand. Reduced demand means lower grocery prices. The price of coffee, sugar, and kiwis will skyrocket, this doesn’t affect corn syrup, wheat, or meat as much.

OIL: The price of oil will increase world-wide, but Trump’s deregulation of the energy industry and reduction of federal taxes on gas could offset this for the domestic market.

BOTTOM: The market is down -17%. I expect it to continue to -23%, at which point, the news will go hysterical, saying “we are officially in a recession.” This will drive the market sharply down further, and we could see a -40% loss in the SPY, sending us back 3.5 years to December 2020.

TAXES AND REGULATION: Trump will try to institute tax cuts and reduce regulation. If Trump’s tax cuts are smaller than expected, and if DOGE hits judicial roadblocks, then the picture gets much worse than I have predicted. Congress and the courts will try to sabotage Trump for political reasons (as McCain did back in 2017 with repealing Obamacare), but whether or not they will be successful is another question.

STOCKS AND RECESSIONS: The Stock Market is not 1:1 with recessions. The stock market was hot from April 2020 through the end of 2021, even though many people lost their jobs and had difficult financial circumstances, like decreased housing availability.

AI LAYOFFS: AI could lead to layoffs, and people might need 6 months or so to adjust and get new jobs, during which period unemployment could go higher. But at the same time, AI will drive profits upward! This is how you get rising unemployment and a rising SPY at the same time.

REBOUND GROWTH: If I’m correct, then panic selling will eventually meet with real economic data, and the market will sharply recover, as it did between April and November 2020. You don’t want to miss out on that rebound growth!

VIX: the volatility index will peak in the next week, even if the stock market continues to decline beyond that. 90% confident it won’t go past 60; 99% confident it won’t go past 80. At that point, the market will bottom out in the next 6-9 months — unless there is an AI bubble, in which case the stock market will bottom out in 2 years.

Conclusion:

I just bought one share of the SPY at $510.

I expect to buy another share at $483.

In the worst case scenario, I expect the SPY to bottom out at $367 within 6 months.

In the best case scenario, I expect a partial recovery by May 21st.

In the middle-case scenario, I expect a full recovery by November, driven by higher inflation.

This could be the calm before the AI storm. Or, depending on how you like to mix your metaphors, this is the thunderstorm before the partially cloudy, partially sunny day.

Whatever money you don’t need before November, if you want to gamble, the SPY isn’t a bad option. There are some individual stocks that might benefit from tariffs, like NVIDIA, but I wouldn’t counsel trying to beat the market.

If you’re bearish on Trump and his tariffs, buy some 3-Month Treasury Bonds at 4% and see how the market goes in July. Before Trump announced his tariffs, I already locked everything else into Bonds until June.

It’s not really wise to purchase anything longer than 3 months, because if Treasury Bonds go up (as some are predicting, against Trump’s wishes), then you could be missing out on higher yields.

Summary:

If you’re high risk and trust the plan, put everything in the SPY now, and expect an 80% return on investment by 2028. (15% YoY SPY growth with inflation)

If you’re moderate risk and think the hysteria is overblown, put 5% of your savings in the SPY and 95% in 3-Month Treasury Bonds. Then, when things seem safer in July, go ahead and buy the dip and ride the recovery. (Expect 8.8% YoY SPY growth with inflation)

If you’re low risk and believe that the economy is going to crash, go for a 6-Month Treasury Bond and see how things look in November. When the VIX spikes, the market usually bottoms out within 6-9 months. At worst, hold off on investing till 2027.

A re-run of the 2000 Dot-Com Bubble seems unlikely because inflation was relatively low during that period, and I think tariffs will be inflationary.

I am generally hopeful about the American economy because of AI. In the worst case scenario, Trump crashes the economy, a Democrat gets in for 2028, and all the tariffs are reversed.

Tariffs are a tax. Taxes are bad for economic growth. However, they are much better than regulation and speculation. The 2000 Dot-Com Bubble was caused by tech speculation; the 2008 crash was caused by housing speculation. Whatever speculative bubbles have built up around AI will probably diffuse by using tariffs as an excuse.

2025 seems like a re-run of COVID. Lockdowns hit the stock market hard, then it rebounded quickly. The job market was slower to rebound, and inflation was tough for low-income people. I’m not predicting good job growth or low inflation under Trump. But even if the economy sucks for low-income people, that doesn’t mean the SPY is a bad investment, relative to bonds or cash.

(internal tariffs plus external tariffs)

This rule doesn’t apply to incumbents, but Trump won’t be the incumbent in 2028.

Compound interest brings the total to 15% over 10 years.

I don’t know any of this stuff I just buy the indexes and forget about it.

Chat am I cooked

Footnote 3 makes no sense given it's a yearly growth rate - being over 12 years makes it even more impressive (although admittedly being preceded and postceded by a crash makes it less impressive).