Every city in America has the same exact problems:

Crime;

Pollution/Sanitation;

Congestion;

Homelessness/Vagrancy/Mental Illness/Drug Use.

It doesn't matter where you go, you will find one or more of these problems. The solution is very simple. Remove criminals and dependent adults. By “dependent adults,” I mean people who are not tax payers (poor, disabled, uneducated).

By “remove” I don’t mean kill or sterilize. Congested, overloaded, polluted, crime-ridden cities are not optimal places for helping disabled, suffering, and unprivileged people. They need free housing, and that is very expensive to build in cities, and much cheaper to build in rural areas.

For example, let’s say we want to give a free house to one million poor people. It would be much cheaper to build one million homes in Kansas than in New York City.

If we could figure out a way to get poor people out of existing cities, we could afford to build 5x as many houses in the middle of Kansas as we could in the city of New York. The money saved could then be dedicated to ensuring access to food and water. Trying to get poor people jobs or education is an investment with negative returns. They deserve free shelter, food, and water, but it is not the job of the state to draw blood from a stone.

Assuming this is all true, how could this be accomplished?

Phase One: Cash Payments

Criminals and dependent adults can be incentivized to leave American cities by cash payments. These cash payments will be established as follows:

If you leave the proscribed area within 30 days, you get $12,000. For a couple, that would be $24,000, which is enough to buy a mobile home or RV.

The cash benefit would decrease by $1,000 every 30 days, finally reaching $2,000 at month 11.

Phase 2: Welfare Shutdown

At the 12 month mark, after 360 days of begging, pleading, advertising, and cash incentives, all welfare in cities is totally shut down. That includes:

Subsidized education. Parents choosing to remain in the city would have to pay for private school or homeschool.

Subsidized healthcare, like Medicare and Medicaid, would no longer be valid for payment within city limits. Senior citizens would either have to purchase private insurance or risk medical bankruptcy.

Subsidized housing, including elderly housing, Section 8 Housing, and all other forms of affordable housing. All of these units would be privatized with subsidies removed. Tenants remaining would pay the full price to the property owner without government assistance.

Food Stamps. EBT cards would no longer function within city limits.

Prisons. The prison population would be relocated to humane cities of refuge built in Kansas, or given the option of exile on the condition of securing a visa. If this could not be politically accomplished, in the worst case scenario, new prisons would be built in Kansas. At the end of their sentences, prisoners would be released into the middle of Kansas and given free housing.

Subsidized transportation. Train and bus systems would be privatized and no longer subsidized by the government.

Some public infrastructure would be maintained, including police, sanitation, electricity, water, and utilities. Otherwise, everything would be sold off and privatized to the highest bidder. This is phase one.

Phase 3: Neo-Georgist Property Tax.

In Phase 3, a federal property tax is imposed on all property where the population is more than 10,000 people per square mile.

The federal property tax would not be based on property value, but on land area. The tax would be $10 per square foot. Assuming the smallest possible plot would be 20x20 (a tiny house), the minimum yearly property tax would be $4,000 per year, or ~$333 per month.

New York City has 8.8 million people in an area of 300.5 square miles. This comes out to 8.38 billion square feet, meaning that the total yearly property tax on New York would be $83.8 billion. Divided between each current resident equally, this comes out to an average yearly property tax of $9,523 per person.

The cost of a studio apartment in NYC is around $29,952 per year, so an increase of $9k represents an increase in rent of 31.79% for New York’s working class residents.

That would be devastating for the working class, but manageable for people earning $200k a year. As long as the city gets better (less pollution, less crime, less drugs, less vagrancy), rich people would be happy to pay more to live in a nicer city.

Example: Central Park Tower

The ground floor of Central Park Tower is 285,000 square feet, and the total square footage of all rooms contained within it is between 895,000 and 1,285,308. The base of the tower is a large commercial shopping mall, while the square footage of the tower itself is only 52,700 square feet.

For Central Park Tower, the tax assessed would be $2.85 million per year. Divided between 179 residents, this comes out to $15,922 extra per year. Since the cheapest studio apartment is $108k a year, this would be, at most, a 15% increase in the price of rent, although for those paying $960k a year, the increase would be closer to 2%.

Some of this tax burden could be mitigated by providing compensation by reducing the income tax. New Yorkers would see between a 2-32% increase in their property tax, passed on through rent, but they could also be granted exemptions from state and federal income tax to compensate for this.

In the case of New York, the effective state and federal income tax comes out to 31.09%, and this could be eliminated to help prevent the flight of rich, wealthy, and productive residents. This assumes a federal government powerful enough to override the state tax system, but the state would be compensated with the proceeds of the property tax, so there would be no loss to state or federal budgets.

New York currently receives $108.24 billion in taxes per year, which is a far cry from the $83.8 billion proposed by my new land-based (neo-Georgist) system. However, when you consider the cost of food stamps, crime, pollution, vagrancy, Medicare, Medicaid, housing subsidies, and public education, New York would also have much smaller government expenditures.

NYC accounts, roughly, for half of the budget of New York State. The state spends $30 billion on “medical assistance,” and $40 billion on K-12 education. Assuming that 50% of this budget comes from and is spent in NYC, then cutting these two programs would result in a $35 billion budget surplus. This should allow NYC to get by on a property tax without the need for an income tax.

Phase 4: Building Kansas.

At this point, the population of the city has reduced by somewhere between 10% (underemployed population, U-6) and 40% (non-working population).

The streets are now miraculously clean and empty. Vagrants and criminals are gone — they have taken their cash and gone elsewhere. The “working poor” who live on food stamps and subsidized housing are gone. Due to the federal property tax, rent has increased by at least $400 per month, which prices out many in the lower classes. The city has partially evacuated.

Wages rise in order to attract workers from outside the city. Janitorial jobs, for example, must be fulfilled by commuters. This does somewhat increase the amount of traffic, but since most janitorial work is performed overnight, it does not produce much congestion. Since it would be more expensive to hire janitors to commute to the city, this would place innovative pressure on the development of robotic cleaning systems.

Many restaurants go out of business, since they cannot afford to pay their taxes or waiters and waitresses. Lower-class parts of the city become a ghost town.

If 40% of the city of New York leaves within 30 days, that’s 3.5 million people who need their $12k cash. The total cost comes out to $42.2 billion dollars, which is quite a lot.

If only 10% of the city leaves within 12 months, that’s 880,000 people, and that comes out to $1.75 billion.

Even if this cost would be quite expensive up front, it would be an irreversible and one-time payment: none of these people would return, since there would be no welfare to return to. It is an investment in the future of the city.

Assuming a budget surplus of $35 billion per year by cutting public education and healthcare, New York could then spend all this money (from health-welfare and education-welfare) on housing in Kansas.

If each mobile home (or room in a studio apartment) could be constructed for $10k each, this would mean new and permanent housing for 3.5 million people, which is 40% of the population of New York.

Phrase 5: National Academy System.

The federal government establishes the National Academy System. The NAS is an educational program with seven requirements:

Must be at least 16 years of age, with parental permission.

For male-identified: must be able to run a mile in 8 minutes; must be able to perform 40 pushups in 2 minutes. For female-identified: one mile in 10 minutes.

A clean disciplinary and criminal record. No fights, no drugs, no vandalism, graffiti, bullying, anything. No suspensions from school or pink slips.

A letter of recommendation from a principal and three teachers.

Two years of mandatory military service or Peace Corps service at age 18 and age 21, in year three and six of the six year program.

An assumption of an $80,000 loan, which will be forgiven upon successful completion of the program. Failure to complete the program will result in the loan being repaid over 30 years, for a monthly payment of $337 at 3% interest. Failure to pay on time will result in garnishment of wages.

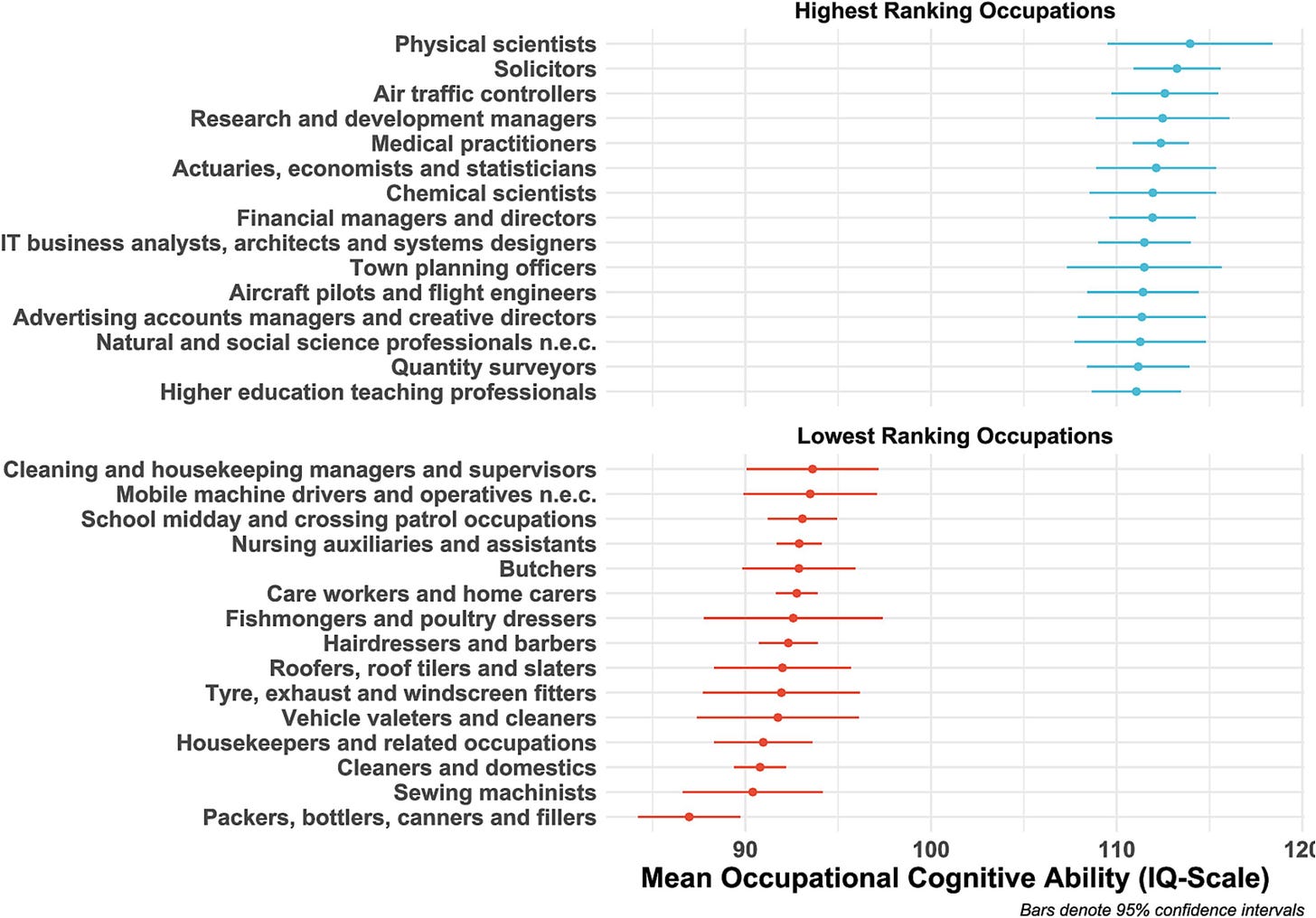

Minimum IQ of 100, or SAT equivalent.

Admissions

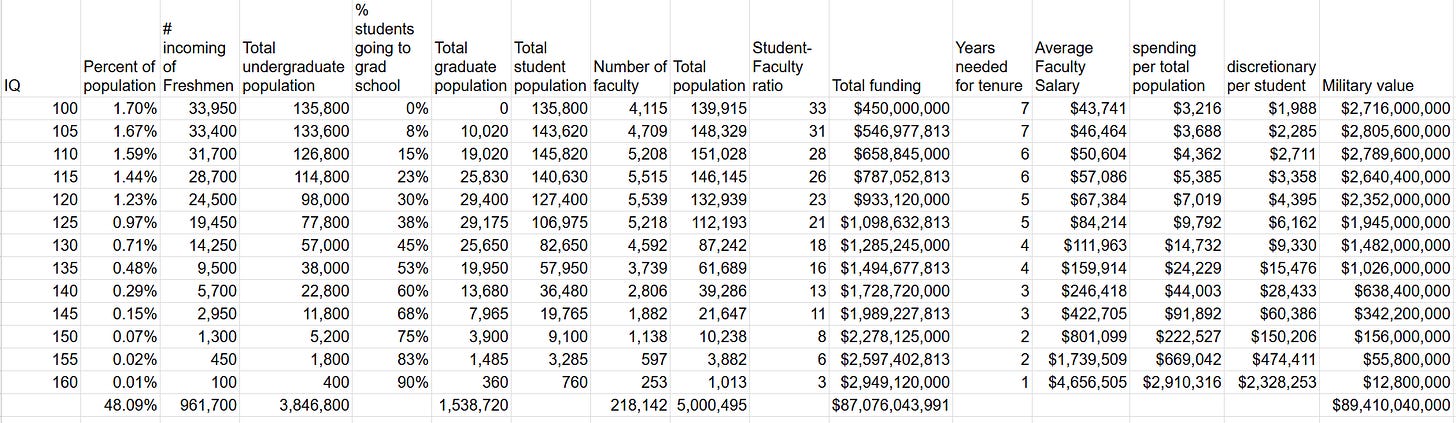

There are approximately 4 million 16 year olds in America. Half of these have an IQ over 100, and half of those can meet the physical standards required (8 minute mile for males, 10 minute mile for females). This means that there would be a potential incoming class of 1 million students per year.

If all students were retained with a 0% drop out rate, this means that over a 4 year period (minus the 1 year of service) there would be a total student population of 4 million. This is much smaller than the current 19 million college students enrolled today, likely due to IQ restrictions and physical fitness restrictions.

The NAS program would pay for itself by providing the military with free recruits. Every year, 2 million NAS students would participate in either military or Peace Corps service, which would eliminate the military’s recruitment shortage without the need to pay the students. The total cost of the program would be $87 billion, and the total value to the military would be $89 in terms of free bodies.

How would the students be housed? 40% of funding would go toward faculty salaries, while 60% would go toward discretionary spending. This discretionary spending would be under the purview of the director.

At the lowest tier school (100 IQ), when faculty salaries are removed, only $270 million remains to house a total student population of 136k. How can the NAS afford to house 136k students with less than $2,000 available for each student?

The answer lies in the property tax mentioned earlier. When the NAS purchases a building, it becomes exempt from the $10/sqft property tax. Property owners looking to leave the city would sell to the NAS, which would then pay nothing in property tax on the building. This would provide cheap and affordable housing for students and faculty in NAS-owned buildings.

Academic Freedom

Ideally, curriculum and standards for these schools would be determined by faculty and the director.

Discretionary funding would be entirely determined by the director, who would be elected by vote of seniors every five years. The director could be any citizen under age 50, including current students.

The director has two powers:

To unilaterally direct discretionary funding. He could either give cash directly to students in the form of a stipend, build statues depicting his own glory, or buy expensive lab equipment for medical study.

To hire and fire non-tenured faculty members.

For example, students could elect Obama as the director of the school. Obama could then fire all the non-tenured faculty members and hire Marxists.

At the top NAS schools, tenure would be granted after 2 years. This would make it extremely difficult to fire professors, and it would be a rare occurrence for new professors to be hired.

Tenure would expire for professors at age 40, and they would be automatically dismissed at age 50.

For a city of 8.8 million people, a loss of 10% of the population is equivalent to a loss of 880,000 people. The idea would be to induce the four million NAS students to partially fill this gap.

conclusion.

These are radical proposals that are intended to have the maximum effect in the least amount of time. They would require total federal autocracy without any respect for the rights of individual states. Therefore, none of this is likely to happen. But it could, if there was sufficient political will.

Figuring out the details needs some tweaking. Should people be given more cash up front, or less? Should the property tax be higher or lower? Besides providing housing to these new residents of Kansas, how can they be provided with free food and water?

This is a rough draft to demonstrate the feasibility of emptying out the cities and relocating poor people into rural America. It is possible, affordable, and feasible to solve the problems of congestion, inner city crime, gangs, ghetto culture, and mentally ill people doing drugs on the street.

It is not logical to help people “in place.” It is extremely expensive to build housing in cities, and extremely cheap to do so in Kansas. The biggest expense is housing. Once that is conquered, the rest is a footnote.

Poor people are not productive members of the economy. They receive more in government benefits than they contribute through low-skilled labor. A janitor provides some value, but he also likely benefits from affordable housing, healthcare, foodstamps, public schools, and other socialist programs. Relocating poor people outside of cities will increase the cost of janitorial labor due to the cost of commuting, but maybe the NAS students can pick up a job doing janitorial work.

The point is to totally eliminate, as quickly as possible, all signs of gang activity, graffiti, vandalism, fecal matter, vomit, needles, drug abuse, mental illness, murder, robbery, begging, dirt, filth, pollution, and congestion. If the goal is to help these people causing these problems, that can be more efficiently done in Kansas than in New York.

The reason why poor people don’t leave New York for Kansas already is because all these benefits are state and city based. These people don’t have money for a bus ticket, and Kansas doesn’t offer people affordable housing in the way that New York does. By creating a national (rather than local) welfare system, everyone benefits.

Fine work here Comrade. One question. Have you looked at a person? Do you know how laughable your tax rates, motivational assumptions and standards are? You sound like the 4chan chuds of 2015 planning how to get a girlfriend by Stockholm syndrome and Costco bulk eggs

Delightfully fascist!